How To Get A Small Loan

Whether you're borrowing money to consolidate debt, move cross country or finance an adoption, a personal loan can help cover your expenses.

Most personal loans are unsecured loans , meaning they don't require collateral such as a house or car. Loan amounts generally range from $1,000 to $100,000 and are repaid in fixed payments, typically over two to seven years. Rates and terms vary based on your credit.

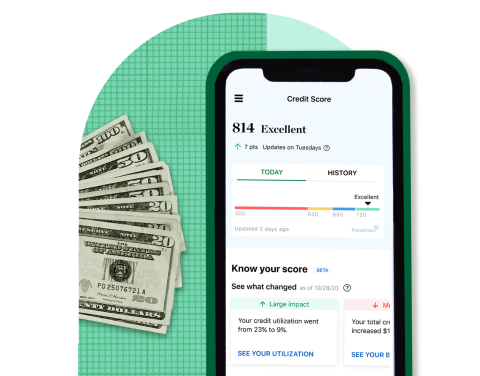

1. Check your credit score

A strong credit score gives you a better chance of qualifying for a personal loan and getting a lower interest rate. Assess your creditworthiness by checking your score. In general, scores fall into the following categories:

-

720 and higher: Excellent credit.

-

690-719: Good credit.

-

630-689: Fair or average credit.

-

300-629: Bad credit.

Looking at a less than friendly score? Take steps to build your credit before you apply. The biggest factors affecting your credit score are on-time payments and the amount of credit you use relative to credit limits.

Fix any errors that might be dragging down your score. You can request your free credit report and dispute wrongly reported missed payments or other inaccuracies it may contain.

Be ready for any loan application

NerdWallet tracks your credit score and shows you ways to build it — for free.

2. Decide how much to borrow

Determine the specific loan amount you need, and avoid borrowing more than that. A larger loan amount has more interest and higher monthly payments that can strain your budget.

3. Compare estimated rates

Knowing your credit score will give you a better idea of the annual percentage rate and payment amounts you might receive on a personal loan. Use the calculator below to see estimates and consider the impact of monthly payments on your budget.

4. Get pre-qualified for a loan

Pre-qualifying for a loan gives you a sneak peek at the offers you may receive. Many online lenders perform a soft credit check during pre-qualification that doesn't affect your credit score.

-

Loan purpose.

-

Loan amount.

-

Income.

-

Monthly debt obligations (rent, student loans, etc.).

-

Address, email, phone number.

-

Date of birth.

-

Citizenship status.

-

Employer name and location.

-

College name and degree.

Some reasons for being denied include:

-

Low credit score.

-

Too little income.

-

Little or no work history.

-

Too many recent credit inquiries, such as credit card applications.

5. Shop around for personal loans

Online lenders, banks and credit unions offer safe unsecured loans . Compare your pre-qualified offers with loan amounts, monthly payments and interest rates from various lenders to get the best loan offer.

Some big financial institutions, like Citibank , Discover and Wells Fargo , also offer unsecured personal loans.

Compare loan companies

| Online lenders | Banks | Credit unions | |

|---|---|---|---|

| Estimated APR ranges | 6% - 36%. | 5% - 29%. | 9% - 18%. |

| Loan amounts | $1,000 - $100,000. | $1,000 - $100,000. | $250 - $50,000. |

| Best for | Online loan process and pre-qualification with soft credit check. | In-person contact and lower rates for existing customers. | Flexible terms and softer credit requirements for members. |

6. Compare your offers with other credit options

Before selecting a personal loan:

See if you qualify for a 0% credit card. Have good or excellent credit? You may qualify for a 0% interest credit card on purchases for a year or longer. If you can repay the loan within the card's introductory period, this is likely the cheapest option. But if you're unable to repay in that time frame, APRs can be as high as 25%.

Consider a secured loan. Bad- or fair-credit borrowers may get a lower APR with a secured loan . You will need collateral, such as a car or savings account. If you're a homeowner, a home equity loan or line of credit can be significantly cheaper than an unsecured loan. However, failing to repay your debt can result in you losing the asset.

Add a co-signer. If qualifying on your own is a challenge, a co-signed personal loan may be an option. Lenders typically consider the credit history of you and the co-signer when approving a loan and may offer more favorable terms.

7. Read the fine print

Before signing a loan, read the terms of the loan offers and get answers to your questions. In particular, watch for:

Prepayment penalties. Most online lenders don't charge a fee for paying off the loan early, which is called a prepayment penalty.

Automatic withdrawals. If a lender allows payments to be automatically withdrawn from your checking account, consider setting up a low-balance alert with your bank to avoid overdraft fees.

APR surprises. The total cost of your loan, including any origination fees — interest and upfront costs — should be clearly disclosed and figured into the APR.

In addition, look for these consumer-friendly features:

Payments are reported to credit bureaus. You can grow your credit score if the lender reports on-time payments to credit reporting agencies.

Flexible payment features. Some lenders let you choose your payment due date, forgive an occasional late fee or allow you to postpone payment in case of hardship.

Direct payment to creditors. Certain lenders will send borrowed funds directly to creditors, which is especially beneficial for borrowers who are consolidating debt .

8. Application and approval

Once you've selected a lender that matches your needs, you'll need to provide documentation to formally apply for the loan .

Application requirements may vary by lender, but you'll likely need:

-

Identification: A passport, driver's license, state ID or Social Security card.

-

Verification of address: Utility bills or lease agreement.

-

Proof of income: Pay stubs, bank statements or tax returns.

The lender will run a hard credit check that may briefly decrease your credit scores by a few points and show up on credit reports for 24 months. Upon final approval, you'll receive your funds according to the lender's terms, typically within a week.

How To Get A Small Loan

Source: https://www.nerdwallet.com/article/loans/personal-loans/cheap-personal-loans

Posted by: fauljectle.blogspot.com

0 Response to "How To Get A Small Loan"

Post a Comment